VTNR stock has gained significant attention among investors due to its dynamic performance and industry presence. Understanding the key factors affecting its value is essential for making informed investment decisions. As part of the energy sector, it holds strategic importance in the market. Investors often analyze stock trends, company fundamentals, and market conditions before making any commitments.

The company behind VTNR has a strong presence in the renewable energy space, making it an attractive option for those interested in sustainable investments. Investors must evaluate financial statements, revenue growth, and industry developments to understand its potential. As demand for renewable energy rises, VTNR stock has positioned itself to capitalize on this growing trend.

History and Background of VTNR Stock

VTNR stock belongs to a company with a rich history in the energy sector. Over the years, it has transitioned from traditional energy sources to renewable and sustainable solutions. This shift has impacted its stock performance and market perception. Investors tracking stock should consider historical price trends and the company’s strategic decisions.

The company has made several acquisitions and investments to strengthen its market position. These decisions have influenced the volatility and growth prospects of VTNR stock. Studying its past performance provides insights into potential future movements. Long-term investors analyze these trends to make data-driven decisions.

VTNR Stock Performance Over Time

Stock performance is a crucial aspect that investors consider before investing in VTNR stock. Analyzing historical data helps understand price trends and future potential. Below is a table highlighting VTNR stock performance in recent years:

| Year | Opening Price | Highest Price | Lowest Price | Closing Price |

| 2020 | $0.85 | $2.50 | $0.70 | $1.90 |

| 2021 | $2.00 | $8.50 | $1.90 | $7.50 |

| 2022 | $7.80 | $15.20 | $6.50 | $12.30 |

| 2023 | $12.50 | $18.00 | $10.00 | $15.50 |

This table provides a snapshot of VTNR stock performance. Investors use this data to analyze patterns and make future investment decisions. The stock’s volatility indicates both risks and opportunities for investors looking to capitalize on price movements.

Factors Affecting VTNR Stock Price

Several factors influence the price of VTNR stock, making it essential for investors to stay informed. Some of the key factors include:

- Market Trends: The overall market condition significantly affects VTNR stock. Economic downturns or bullish trends impact stock prices accordingly.

- Company Earnings: Financial performance, revenue growth, and profitability play a crucial role in determining stock value.

- Government Policies: Regulations related to energy production and environmental laws can influence VTNR stock movements.

- Investor Sentiment: Public perception, news, and analyst ratings can drive price fluctuations.

- Technological Developments: Innovation in renewable energy and advancements in technology can impact stock growth.

Understanding these factors helps investors make well-informed decisions about buying, holding, or selling VTNR stock.

Crucial Point You Must Understand: Persona-3-reload-fusion-calculator-guide-for-efficient-results

Future Prospects and Growth Potential

Investors are always interested in the future growth potential of VTNR stock. The company’s expansion into renewable energy provides promising opportunities. Below is a table highlighting key future growth drivers:

| Growth Driver | Impact on VTNR Stock |

| Expansion in Renewable Energy | Increases investor confidence and stock value |

| Strategic Partnerships | Strengthens market position and revenue streams |

| Government Incentives | Supports industry growth and stock appreciation |

| Technological Advancements | Enhances efficiency and cost-effectiveness |

| Market Demand | Higher demand leads to increased stock value |

These factors indicate a positive outlook for VTNR stock. Investors looking for long-term gains should consider these growth drivers before making investment decisions.

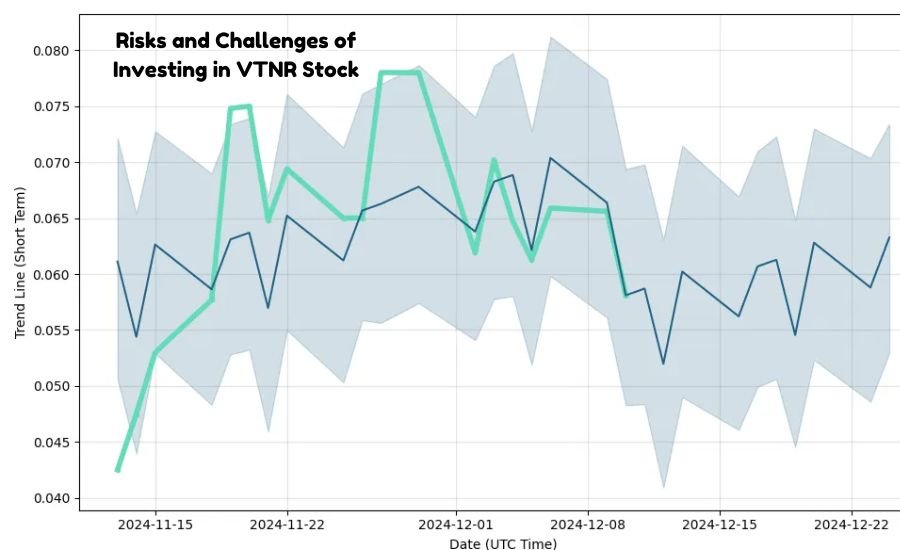

Risks and Challenges of Investing in VTNR Stock

Like any investment, VTNR stock carries certain risks that investors should be aware of. Some key risks include:

- Market Volatility: Stock prices can fluctuate significantly due to external factors.

- Regulatory Changes: Government policies and environmental laws can impact the company’s operations.

- Economic Downturns: Recession or economic slowdowns may affect investor sentiment and stock performance.

- Competition: The renewable energy sector is highly competitive, affecting VTNR stock’s market share.

- Operational Risks: Challenges in production, supply chain, or management decisions may impact stock value.

Understanding these risks helps investors take precautionary measures while investing in VTNR stock.

Conclusion

Investing in VTNR stock requires thorough research and analysis. The company’s focus on renewable energy, strategic growth plans, and strong market presence make it a compelling option. However, investors should consider market trends, risks, and future growth potential before making investment decisions.

stock has demonstrated strong performance over the years, and its future outlook remains positive. Investors should continuously monitor industry developments, company earnings, and market conditions to maximize their investment potential. By staying informed and making data-driven decisions, investors can leverage the growth opportunities presented by VTNR stock.

You Should Be Aware Of: Average-marathon-time

FAQs

What does Vertex Energy do, and why is it important?

Vertex Energy is a company that specializes in refining and renewable energy solutions. It plays a crucial role in producing sustainable fuel alternatives, making it an essential player in the growing clean energy market.

Is investing in this company a good idea for long-term growth?

Investing in this company can be a good option for long-term growth, especially due to its focus on renewable energy. However, investors should conduct thorough research, analyze financial statements, and assess market trends before making any investment decisions.

What factors influence the company’s stock price, and how do they impact investors?

Several factors affect stock price movements, including overall market conditions, financial performance, government regulations, investor sentiment, and industry competition. These factors impact investors by determining potential risks and rewards in stock trading.

How has the company’s stock performed in recent years, and what trends should investors watch?

The stock has shown significant growth and volatility, particularly after expanding into renewable energy. Investors should closely monitor price movements, quarterly earnings, and industry developments to identify profitable opportunities.

Does this company pay dividends, or is it focused on reinvestment?

Currently, the company does not offer dividends, as it focuses on reinvesting profits into business expansion and technological advancements. Investors seeking dividend income may need to consider other stocks.

What are the biggest risks of investing in this VTNR stock, and how can investors mitigate them?

The key risks include stock market volatility, regulatory changes, competition in the energy sector, and operational challenges. To mitigate risks, investors should diversify their portfolios, stay updated with industry news, and set clear investment goals.

Where can I buy shares of this company, and what is the process?

Shares can be purchased through stock exchanges using online brokerage platforms such as Robinhood, E-Trade, Fidelity, or TD Ameritrade. Investors need to open a brokerage account, deposit funds, and search for the stock ticker to place a buy order.

What is the long-term outlook for this investment, and what growth factors should investors consider?

The long-term outlook appears positive due to the rising demand for renewable energy. Investors should consider factors such as government incentives, advancements in clean energy technology, strategic acquisitions, and global energy trends before making investment decisions.

How can I stay updated on company news and VTNR stock market movements?

Investors can stay informed by following financial news websites like Bloomberg, CNBC, and Yahoo Finance. Additionally, subscribing to the company’s investor relations page and monitoring stock market apps can provide real-time updates.

Should I hold or sell my shares, and what factors should influence my decision?

The decision to hold or sell depends on market conditions, the company’s financial health, and individual investment goals. Investors should analyze quarterly reports, track stock performance, and consult financial advisors before making any major decisions.