The Ramsey Retirement Calculator is a useful tool for planning your financial future. It helps individuals estimate how much they need to save for retirement based on their income, expenses, and lifestyle choices. This tool considers inflation, interest rates, and expected growth to provide accurate retirement projections.Retirement planning can be overwhelming, but with the Ramsey Retirement Calculator, users can break down their financial goals into manageable steps.

By inputting key details such as current savings, annual contributions, and expected retirement age, the calculator generates a personalized retirement plan.One of the biggest advantages of using this tool is that it offers realistic savings strategies. It provides insights into how small changes in savings rates or investment strategies can impact long-term financial security. This makes it an essential resource for individuals at any stage of their career.

How to Use the Ramsey Retirement Calculator Effectively

To get the most accurate results from the Ramsey Retirement Calculator, it is important to enter precise information. The tool requires several inputs, including current age, desired retirement age, savings balance, and expected rate of return.Start by gathering details about your income sources, including salary, pensions, and any passive income. Then, estimate your expected monthly expenses in retirement, considering housing, healthcare, travel, and entertainment.

The calculator will then generate a retirement savings goal based on your inputs.The results will show how much you need to save monthly or annually to reach your goal. If the numbers seem too high, you can adjust variables such as retirement age or investment strategy. By experimenting with different scenarios, users can create a flexible and achievable retirement plan.

Benefits of Using the Ramsey Retirement Calculator

The Ramsey Retirement Calculator offers multiple benefits for individuals looking to secure their financial future. This tool simplifies complex financial planning by presenting clear and easy-to-understand projections.A major advantage is its ability to adjust savings strategies based on different financial situations. Whether you are starting early or playing catch-up, the calculator provides tailored solutions.

It also considers the impact of inflation and market fluctuations, ensuring more realistic estimates. The Ramsey Retirement Calculator encourages long-term financial discipline. By visualizing future savings needs, users are more motivated to stick to their retirement plans. This tool helps users make informed decisions about investments and expenses, leading to a more comfortable retirement.

Key Features of the Ramsey Retirement Calculator

Below is a table highlighting the key features of the Ramsey Retirement Calculator:

| Feature | Description |

| Customizable Inputs | Users can enter their income, expenses, and savings details for personalized results. |

| Inflation Adjustment | The calculator factors in inflation to provide realistic future estimates. |

| Investment Growth Projections | It calculates potential returns based on different investment strategies. |

| Goal Tracking | Helps users track progress and adjust plans as needed. |

| Simple Interface | Easy-to-use design makes retirement planning accessible for all users. |

These features make the Ramsey Retirement Calculator a reliable tool for anyone seeking financial security in retirement.

Planning for Retirement with the Ramsey Retirement Calculator

Effective retirement planning requires a combination of saving, investing, and budgeting. The Ramsey Retirement Calculator helps users understand their financial situation and make adjustments as needed.To maximize your retirement savings, consider contributing to tax-advantaged accounts such as 401(k)s or IRAs.

Investing in diversified portfolios can also help increase returns over time. Cutting unnecessary expenses can free up more money for savings.By using the Ramsey Retirement Calculator regularly, individuals can track their progress and make informed financial decisions. This proactive approach ensures a stable and comfortable retirement lifestyle.

You May Also Like: 70-000-a-year-is-how-much-an-hour-discover-the-exact-hourly-rate

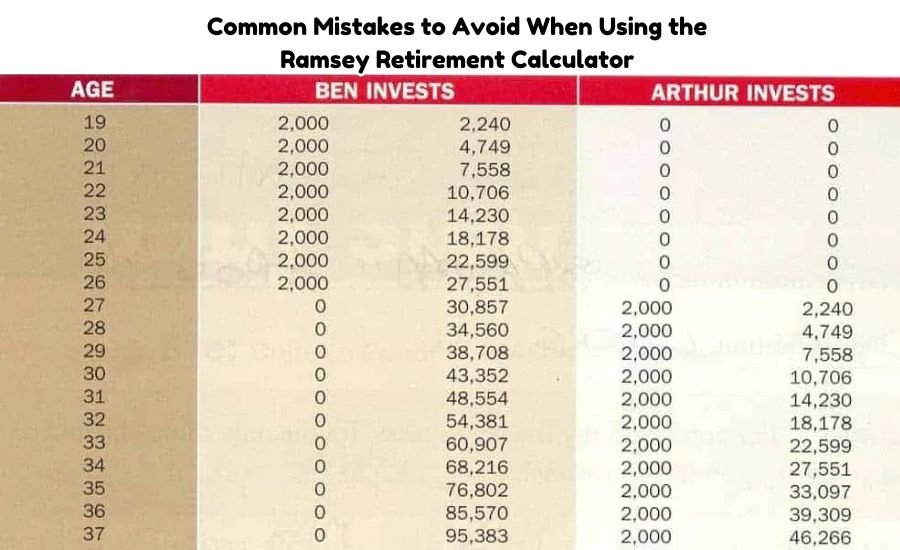

Common Mistakes to Avoid When Using the Ramsey Retirement Calculator

While the Ramsey Retirement Calculator is a powerful tool, users should be aware of common mistakes that can affect its accuracy. One common error is underestimating retirement expenses. Many people forget to account for healthcare costs, travel, and lifestyle changes.Another mistake is relying solely on savings without considering investment growth.

Investing in stocks, bonds, or real estate can significantly boost retirement savings. Users should also update their inputs regularly to reflect changes in income, expenses, and market conditions.Avoiding these mistakes ensures that the Ramsey Retirement Calculator provides the most accurate and beneficial results for long-term financial planning.

Conclusion

The Ramsey Retirement Calculator is a valuable tool for individuals looking to plan a financially secure retirement. By providing accurate projections and customizable inputs, it helps users make informed financial decisions.By using this calculator consistently and making necessary adjustments, individuals can ensure they are on track to meet their retirement goals. Whether you are just starting or nearing retirement, this tool provides the insights needed for a worry-free future.

Taking the time to explore different savings strategies can significantly enhance financial stability. Small changes in savings habits, such as increasing contributions or cutting unnecessary expenses, can have a large impact over time.Retirement planning is not just about saving money but also about making smart investment choices. Diversifying your portfolio and keeping track of market trends can help maximize your retirement fund.

Get The Latest Updates On: Persona-3-reload-fusion-calculator-guide-for-efficient-results

FAQs

What is the Ramsey Retirement Calculator?

The Ramsey Retirement Calculator is a tool that helps individuals estimate how much they need to save for retirement based on income, expenses, and expected growth.

How accurate is the Ramsey Retirement Calculator?

The calculator provides reliable estimates based on the data entered, but actual results may vary due to inflation, market fluctuations, and lifestyle changes.

What inputs do I need for the Ramsey Retirement Calculator?

You need details like your current age, retirement age, savings balance, income, and expected expenses.

Can the Ramsey Retirement Calculator help me retire early?

Yes, by adjusting savings rates and investment strategies, you can use the calculator to plan for early retirement.

Does the Ramsey Retirement Calculator consider social security benefits?

The calculator allows you to include social security and other retirement income sources for a complete estimate.

How often should I update my retirement plan using the calculator?

It’s recommended to update your plan at least once a year or whenever there are major financial changes.

What happens if my savings are not enough?

The calculator suggests adjustments, such as increasing savings, delaying retirement, or changing investment strategies.

Can I use the Ramsey Retirement Calculator if I have debt?

Yes, but paying off high-interest debt first can improve your retirement savings strategy.